A modern government collects required funds through different sources; mainly from revenue and debt. Among different sources, taxation is the most important sources of government revenue and Gross Domestic Product (GDP) of a nation. In... more

The study sought to assess the effect of implementing Electronic Fiscal Devices in VAT collection in Tanzania. The study analysed the importance of Electronic Fiscal Devices to TRA, taxpayers and other stakeholders with the aim of... more

Kuliah Kerja Nyata (KKN) merupakan salah satu bentuk pengabdian masyarakat yang memiliki peran penting dalam menghubungkan dunia akademik dengan realitas pembangunan desa. Program KKN Mandiri 2025 di Desa Rantau Ikil dilaksanakan selama... more

Kuliah Kerja Nyata (KKN) merupakan salah satu bentuk pengabdian masyarakat yang memiliki peran penting dalam menghubungkan dunia akademik dengan realitas pembangunan desa. Program KKN Mandiri 2025 di Desa Rantau Ikil dilaksanakan selama... more

This study aims to determine the system used by the Regional Income Agency in the collection of non-metallic mineral and rock tax in increasing the original income of the region, as well as to know the constraints in the implementation of... more

This research was conducted to determine the level of contribution of Rural and Urban Land and Building Tax (PBB-P2) to Regional Tax revenues in the City of Banjarmasin from 2021 to 2023. The data used in this research is secondary data... more

The issue of collecting tax resources to the consolidated budget has determined and still determines difficulties which cannot be neglected in all the former socialist countries of the Central and Eastern Europe. From the Members States... more

This article focuses on the socio-economic and political experiences of the artisanal diamond miners and the various communities within the hills of Chiadzwa situated in the Marange area of Manicaland Province in Zimbabwe. The diamond... more

Negara Indonesia merupakan negara yang menganut asas Desentralisasi dan Dekontralisasi. Berdasarkan asas desentralisasi dan dekontralisasi tersebut lahirlah daerah otonom dan wilayah administratif yang mencerminkan pembagian tugas dan... more

Pajak Daerah merupakan salah satu sumber pendapatan daerah yang penting guna membiayai pelaksanaan Pemerintah Daerah dalam rangka melaksanakan pelayanan kepada masyarakat serta mewujudkan kemandirian daerah. Menurut Pasal 1 Undang-Undang... more

This study observes the economic impact of tax revenue and economic growth of Nepal from fiscal year 2012/13 to 2022/23. To get the objectives, relevant time series secondary data were collected from the economic survey, websites of NTC... more

Tujuan dari penelitian ini yaitu untuk mengetahui dan mendeskripsikan pelaksanaan Penatausahaan Aset Tetap Pada Pemerintah Kabupaten Bandung Barat dan untuk mengetahui upaya-upaya apa saja yang dilakukan Pemerintah Kabupaten Bandung Barat... more

This study examines the relationship between Nepal's economic growth and tax revenue from the country's fiscal years 2002-2003 to 2022-2023. Relevant time series secondary data were gathered from the World Bank, Nepal Rastra Bank,... more

Pandemi Covid-19 menyebabkan perlambatan pertumbuhan ekonomi Indonesia yang berdampak pada penurunan jumlah penerimaan pajak, ditambah jumlah pajak insentif yang diberikan oleh pemerintah kepada wajib pajak. Tujuan dari penelitian ini... more

Tujuan dari penelitian ini yaitu untuk mengetahui dan mendeskripsikan pelaksanaan Penatausahaan Aset Tetap Pada Pemerintah Kabupaten Bandung Barat dan untuk mengetahui upaya-upaya apa saja yang dilakukan Pemerintah Kabupaten Bandung Barat... more

Automation facilitates the clearance of legitimate trade, improves the efficiency of taxation controls and secures revenue collection. This study aimed at evaluating the factors affecting utilization of electronic tax registers among... more

Penelitian ini dilakukan di Dinas Pendapatan Daerah Kota Pekanbaru mulai Januari sampai dengan Februari 2015. Tujuan dari penelitian ini adalah untuk mengetahui bagaimana Mekanisme Pembayaran Dan Penagihan Pajak Air Tanah Di Dinas... more

Property tax is an important, possibly the most significant and reliable revenue source for many local governments in both developing and developed countries. In developed countries, the tax is typically about 40-80% of local government... more

Innovation refers to the introduction of new products, services, processes, or ideas in conducting businesses. It encompasses both technological advancements and non-technological improvements, such as organizational changes or novel... more

The purpose of this study was to find out the effects of strategic management practices on revenue growth of Selected Lake Region economic bloc counties in Kenya. Specific objectives were; to evaluate the effects of fraud control... more

Asepek terpenting dalam sistem APBN yaitu Pendapatan Asli Daerah (PAD) karena melakukan beberapa fungsi penting, seperti mendukung anggaran belanja daerah, menyediakan layanan publik, mengurangi defisit anggaran, dan meningkatkan... more

This study explores the challenges and strategies for enhancing internally generated revenue (IGR) of Local Government Councils in Nigeria, using Yobe State as a case study. This is due to the fact that Nigeria, as a federal state with... more

Indonesia merupakan suatu negara yang menganut sistem otonomi daerah dalam pengelolaan dan pelaksanaan pemerintahan. Pada pelaksanaan sistem otonomi daerah ini pemerintah pusat memberikan wewenang kepada pemerintah Kota/Kabupaten untuk... more

Nama : Medhiana Khanza NPM : 2116500028 Judul : Pengelolaan Retribusi Pasar Dalam Meningkatkan Pendapatan Asli Daerah Di Kota Tegal. Skripsi, Ilmu Pemerintahan Universitas Pancasakti Tegal. Pembimbing I : Dra. Sri Sutjiatmi, M.Si dan... more

Maximum regional financial management to improve the economy and improve public services to the community is the main spirit in regional autonomy. The objectives of this writing are (1) How to manage regional finances in terms of sources... more

Potensi daerah dalam meningkatkan Pendapatan Asli Daerah (PAD) yang dimiliki dari sektor PBB-P2 menjadi faktor utama pengalihan dari pajak pusat menjadi pajak daerah. Selaku pajak pusat, yang berwenang memungutnya adalah Kantor Pelayanan... more

Sebagai salah satu daerah pegunungan dan daerah hulu DAS Brantas, Kota Batu dianugerahi sumber mata air yang sangat banyak dan mencapai 111 sumber mata air yang telah terpetakan. Dari 111 sumber mata air yang berada di Kota Batu sekarang... more

Restoran. Tujuan penelitian ini untuk menganalisis dan mengetahui upaya pelaksanaan yang dilakukan oleh Dinas Pendapatan Daerah dalam pelaksanaan pasal 12 Peraturan Daerah Kota Malang Nomor 16 Tahun 2010 tentang "Pajak Daerah" terkait... more

Management of Hotel Taxes and Restaurant Taxes in the Context of Increasing Regional Original Income. This study aims to determine and analyze the management of hotel taxes and restaurant taxes by the Regional Office of Financial and... more

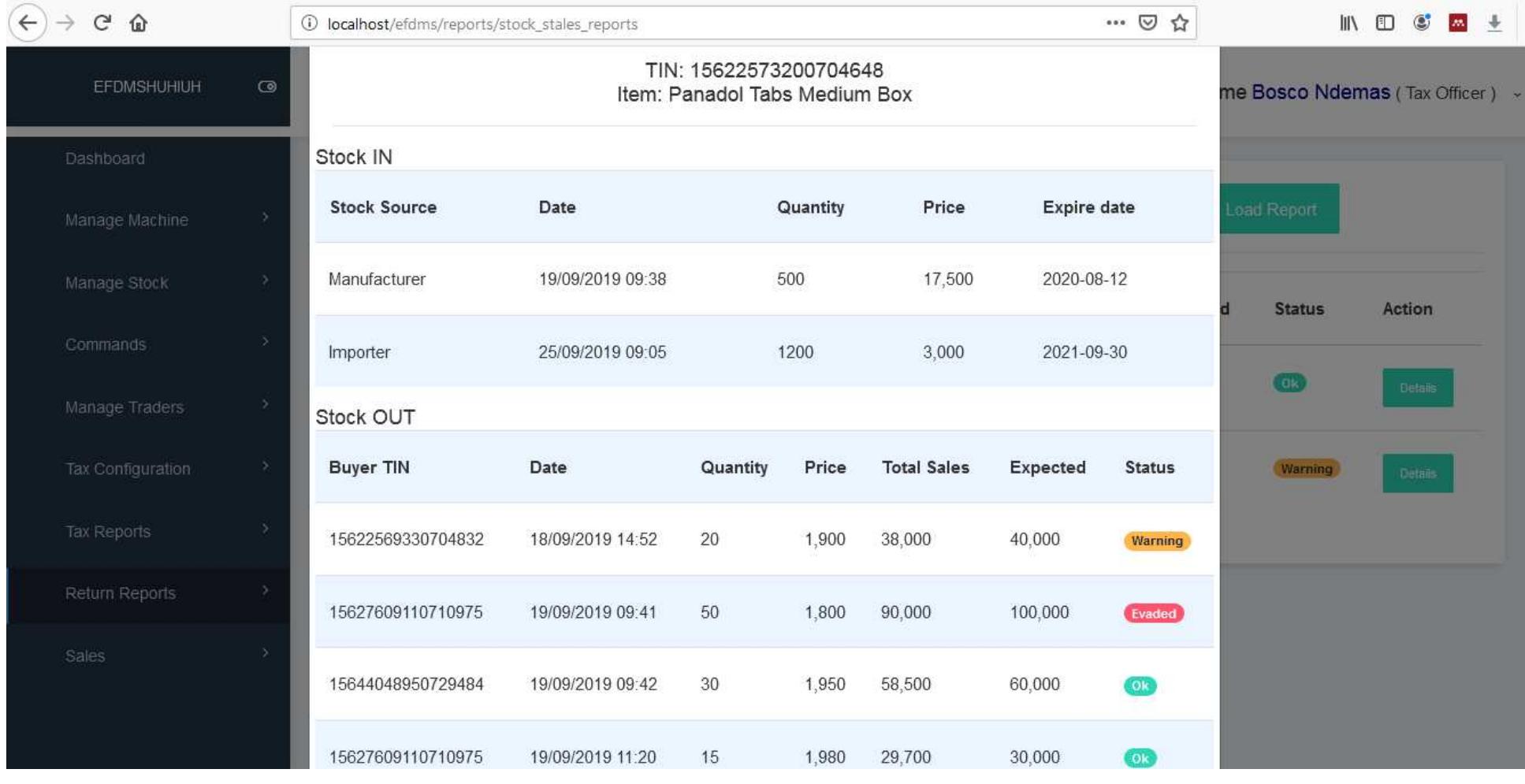

The Electronic Fiscal Device (EFD) Machines have been operating in Tanzania since the year 2010 for the purpose of helping the Tanzania Revenue Authority (TRA) to increase revenues from tax collection. Regardless of years of its... more

The implementation of Value Added Tax (VAT) policy in Nepal has completed almost 24 years. The paper intends to assess the VAT performance in terms of revenue collection over the past two decades of its implementation. An econometric... more

This study aims to analyze the level of efficiency, effectiveness and influence of the Rural and Urban Land and Building Tax (PBB-P2) on Regional Original Income (PAD) in Batang Hari Regency. The data used in this study are primary data... more

This study are to examine the effect of building permit (IMB) retribution on local income of Bulungan District. To analyzes relationship between dependent and independent variables under this study then exercised simple linear... more

Purpose: to describe the quality, factors that hinder and efforts that can be made to improve service quality. Research methodology: The method used in this research is descriptive qualitative research method. Results: The results showed... more

Purpose: to describe the quality, factors that hinder and efforts that can be made to improve service quality. Research methodology: The method used in this research is descriptive qualitative research method. Results: The results showed... more

Parking tax is a local tax imposed under the law number 28 of 2009 on local taxes and user charge. The purpose of this study analyze the adequacyn of the Parking Tax Reception System At the Office of Manado Regional Tax and Retribution... more

The study examined the relationship between tax revenue and economic growth in Nigeria. The study adopted a descriptive and historical research design; secondary data for twenty-two years (1994 -2015) were collected from various issues of... more

The aim of this study is to determine the potential of hotel tax and hotel tax contribution to regional revenue which is owned by the City of Tangerang. The method used is quantitative descriptive, namely research by collecting data in... more

The aim of this study is to determine the potential of hotel tax and hotel tax contribution to regional revenue which is owned by the City of Tangerang . The method used is quantitative descriptive, namely research by collecting data in... more

Penelitian ini adalah untuk meyediakan sebuah media untuk palayanan informasi tentang Pajak Bumi dan Bangunan Daerah di Kota Kayu Agung. Dengan menggunakan ISO 9126. Dalam pengembangan sistem penelitian ini menggunakan metode RAD dan... more

This study examined differences in the local government's financial performance before and after the transition from central tax BPHTB be local taxes? In general, this study aims to determine the contribution BPHTB to the PAD as a... more

Otonomi daerah dijadikan dasar untuk melakukan pembangunan daerah secara mandiri dengan menggunakan sumber daya dan potensi daerah. Hal ini tercantum pada perundang–undangan No. 32 tahun 2004 tentang pemerintah daerah. Sehingga penelitian... more