In the 21st Century, India's micro, small, and medium enterprises (MSME) have established their credibility in mass employment and contributed to around 30% of India's GDP in 2020. As of 2020, India has a house of 2.5 million units and... more

The problem that plagues Indian family-controlled firms is expropriation of minority shareholders by majority shareholders. Gender quota legislation that mandates appointment of at least one female director without specifying the director... more

In recent years, the Islamic financial sector has become one of the most vital sectors in the Islamic economic system in Indonesia. Therefore, more attention needs to be paid to the measurement of Islamic financial inclusion and its and... more

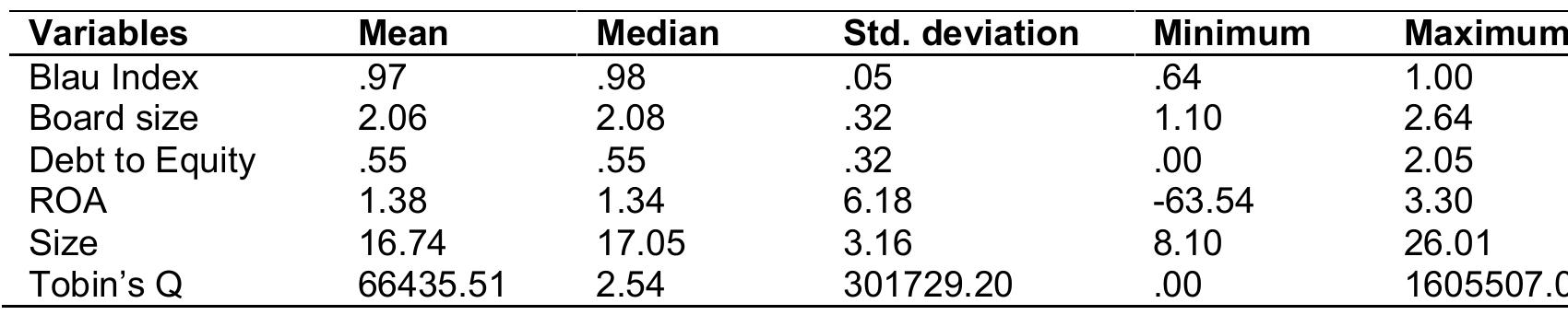

The paper investigates the effect of gender diversity in the boardroom on the financial performance of non-financial listed firms in Ghana using panel data between 2007 and 2011. The fixed and random effects approaches were used in... more

This study analyses how the implementation of accounting and financial information and management control systems affect the performance of family and non-family micro, small and medium-sized enterprises (MSMEs) in the hospitality sector... more

The Micro, Small, and Medium Enterprises (MSMEs) have a strategic role in promoting economic growth and reducing unemployment in a country. This very strategic structure of this informal sector makes MSMEs as one of alternatives for moral... more

We seek to offer some reconciliation for the conflicting theoretical arguments and empirical findings regarding the impact of women's participation in boards on firms' performance. We suggest that this impact differs in relation to... more

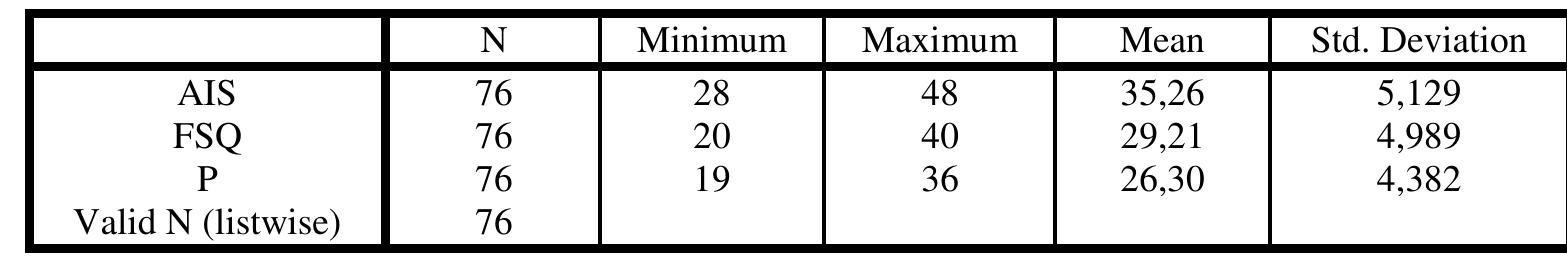

This study aims to determine the effect of management accounting information systems and internal business processes on the performance of micro, small and medium enterprises in Pasuruan. The performance of MSMEs in this study is seen in... more

This paper examines the effect of outside block-holders’ ownership on the demand for corporate monitoring in relation to agency theory in the Malaysian business environment. The results of this study provide evidence that, given the... more

We examined the relationship between blockholder ownership and firm performance in the context of high concentrated ownership in Malaysia coupled with weak regulatory framework. Blockholder ownership is used as monitoring device to verify... more

The monitoring role performed by the board of directors is an important corporate governance control mechanism, especially in countries where external mechanisms are less well developed. The gender composition of the board can affect the... more

Firstly, I would like to thank my thesis supervisor Jorge Bento Farinha for his guidance, critical opinions and helpful suggestions. Moreover, I would like to mention his full availability during the whole year. I would like to... more

Board diversity is important especially in countries which practice a one-tier board system, such as Malaysia. Under the system, board appointments are usually controlled by the firm's substantial shareholders, and as a result, directors... more

The financial system has become an important factor in the economic system and increasingly continues to experience development and innovation in line with the development of the demands of the digital diera community that wants... more

This study provides pioneering empirical evidence on board gender diversity and firm performance relationship for the case of large-scale agri-food companies in Russia. While Russia plays an important role in the global food security, its... more

We seek to offer some reconciliation for the conflicting theoretical arguments and empirical findings regarding the impact of women's participation in boards on firms' performance. We suggest that this impact differs in relation to... more

Carolin van Uum ARTICLE INFO Marc Eulerich, Patrick Velte and Carolin van Uum (2014). The impact of management board diversity on corporate performance-An empirical analysis for the German two-tier system. Problems and Perspectives in... more

This paper is focused on identifying possible relations between companies' performance and their board structure and managerial team after the recent world financial crisis, in an attempt to identify possible ways to support corporate... more

This study investigates, firstly, the influence of family-controlled firm on corporate performance, and secondly, the influences of corporate governance mechanisms including control variable on corporate performance in the companies... more

In times of vivid debates about the role of women on corporate boards, this article investigates the contribution of women directors to board decision-making and strategic involvement. Based on survey data from multiple respondents in 120... more

This paper studies the effect of corporate governance on value creation for listed companies. It also examines whether the fact that a business is owned or partly owned by a family has an impact on this variable as well as the behavior of... more

Over time, this type of cooperative business slowly begins to lose its existencedue to increasingly fierce business competition. This is because the role ofcooperatives, which is identical to the provision of basic foodstuffs for theneeds... more

This paper is focused on identifying possible relations between companies’ performance and their board structure and managerial team after the recent world financial crisis, in an attempt to identify possible ways to support corporate... more

The global financial services sector is transforming as technology advances. Various types of technology based innovative financial business models or financial technology (fin-tech) are growing rapidly around the world, including... more

This paper studies the effect of corporate governance on value creation for listed companies. It also examines whether the fact that a business is owned or partly owned by a family has an impact on this variable as well as the behavior of... more

This study aims to analyze the financial inclusion model on Batik SMEs' development in Cirebon Regency. Six constructs emerge as the objects of interest are financial literacy, financial technology, social capital, capital structure... more

The development of information technology which is supported by the rapid use of the internet has created several fintech that will make it easier for people to get digital financial services. The Financial Services Authority stated that... more

This study examines the relationship between government ownership and performance of listed firms on the Nairobi Securities Exchange. The quadratic term of government ownership is included in the model to test for the effect of increasing... more

This study examines the relationship between government ownership and performance of listed firms on the Nairobi Securities Exchange. The quadratic term of government ownership is included in the model to test for the effect of increasing... more

The dynamics of the use of digital technology in the industrial revolution era 4.0 has had an impact on the financial sector. One of them is the development of financial technology (fintech) in the form of online loan services.... more

Indonesian Coffee and Cocoa Research Institute (ICCRI) is a institution that Conducting research to obtain technological innovation in the field of cultivation and processing of coffee and cocoa products. ICCRI has an Experimental Garden... more

The global financial services sector is transforming as technology advances. Various types of technology based innovative financial business models or financial technology (fin-tech) are growing rapidly around the world, including... more

This study analyzes board diversity and its effect on financial performance, as measured by age, gender, and nationality of board members using a sample of nine (9) commercial banks in Cikarang, West Java, Indonesia. The study uses... more

The purpose of this study is to analyze the ability of MSMEs to improve industrial competitiveness and strategies to improve industrial competitiveness in the context of facing the industrial era 4.0 in an accounting perspective. The... more

This paper examines the effect of outside block-holders’ ownership on the demand for corporate monitoring in relation to agency theory in the Malaysian business environment. The results of this study provide evidence that, given the... more

This article describes the duties, functions and authorities of the Financial Services Authority (OJK) in providing supervision and regulation of the development of types of businesses in the financial services sector in Indonesia, one of... more

This article describes the duties, functions and authorities of the Financial Services Authority (OJK) in providing supervision and regulation of the development of types of businesses in the financial services sector in Indonesia, one of... more

This paper aims to give a unique view of looking at how SMEs in Indonesia applying the concept of smart manufacturing along with the challenges of smart manufacturing adoption in supporting technologies infrastructure in Indonesia and its... more

This article describes the duties, functions and authorities of the Financial Services Authority (OJK) in providing supervision and regulation of the development of types of businesses in the financial services sector in Indonesia, one of... more

Tunisia is considered one of the first Arab Muslim countries to have the freedom of women and their participation in the economic sphere. Despite these advancements in women’s freedom, Tunisia still has a few women in positions of... more

This study aims to analyze the effect of gender diversity in both the Board of Commissioners and Board of Directors, as well as the effect of education background of the President Commissioner on the firm value. Gender diversity is... more

This chapter examines the link between board diversity and firm financial performance for a sample of Dutch listed companies during the recent financial crisis. We examine seven dimensions of diversity: nationality diversity, gender... more

This chapter examines the link between board diversity and firm financial performance for a sample of Dutch listed companies during the recent financial crisis. We examine seven dimensions of diversity: nationality diversity, gender... more

Ownership structure is a crucial determinant factor of the corporate governance measurement and has been associated, in prior studies, with the profitability of firms. The current study investigates the effect of ownership structure on... more

Small and Medium Industry (SMI) is one of the strategic business sectors that is very influential in the industrial revolution 4.0. Industry 4.0 refers to the concept of using the internet of things, as well as smart and cloud-based... more

This study aimed to analyze the practice of the use of Accounting Information Systems (AIS) using IPOS 4.0 application on Micro, Small and Medium Enterprises (MSMEs) in Jember. It can be seen from the aspect of business, scale of... more

Entering the current 4.0 industrial revolution occurred so rapidly technological developments in various sectors of life, including in the financial sector. Technological developments that occurred in the financial sector is slowly... more

This study investigates the predicting power of a board's gender mix on financial performance by using a cross sectional data analysis. Existing literature on this subject is scanty in emerging economies and to the best of the authors'... more

The study examines the perceived effects of corporate governance mechanisms on the value of manufacturing firms in Nigeria by adopting economic value added as the measure of firm value. Corporate governance mechanisms such as concentrated... more

This study analyzes board diversity and its effect on financial performance, as measured by age, gender, and nationality of board members using a sample of nine (9) commercial banks in Cikarang, West Java, Indonesia. The study uses... more