Key research themes

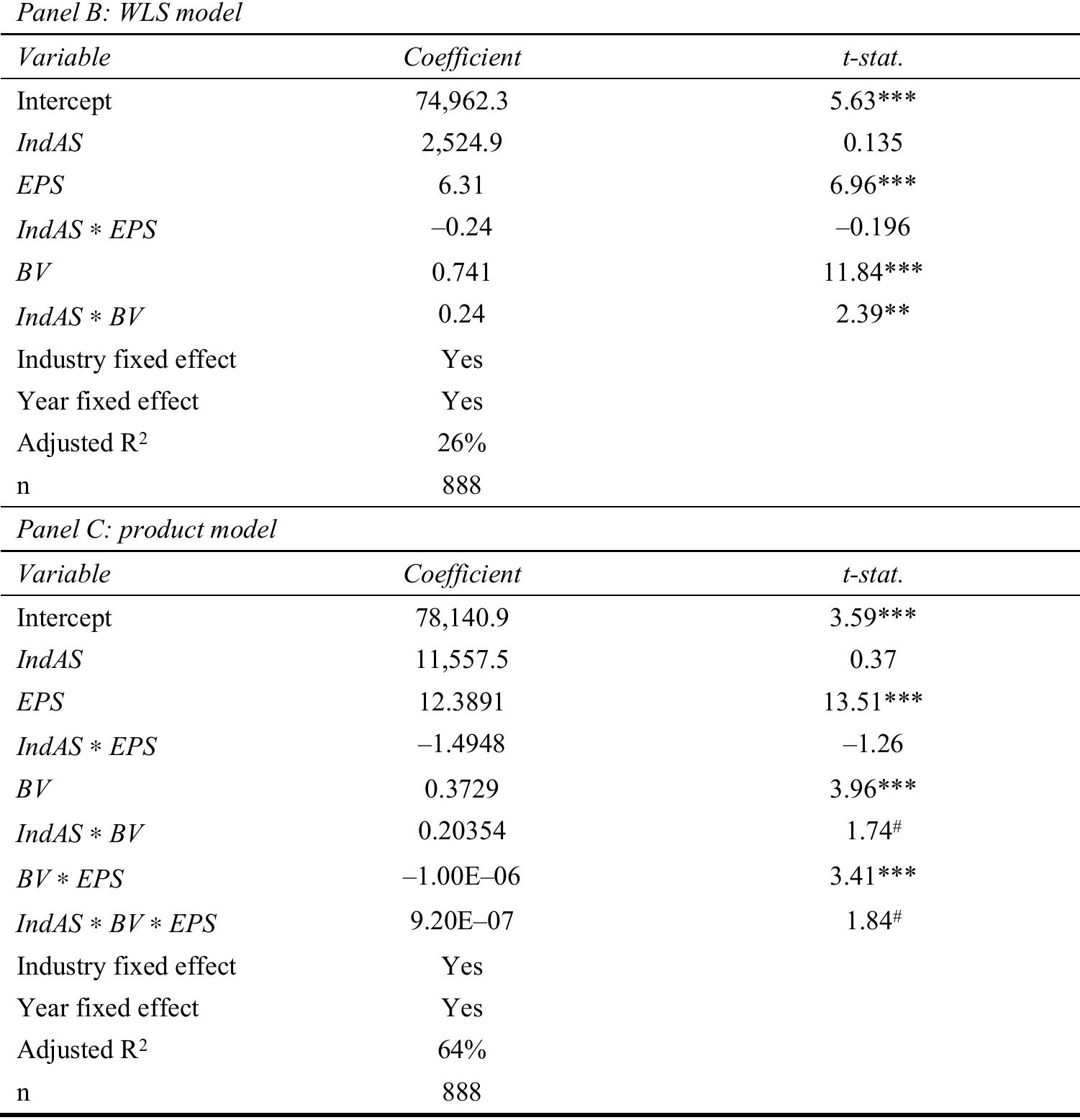

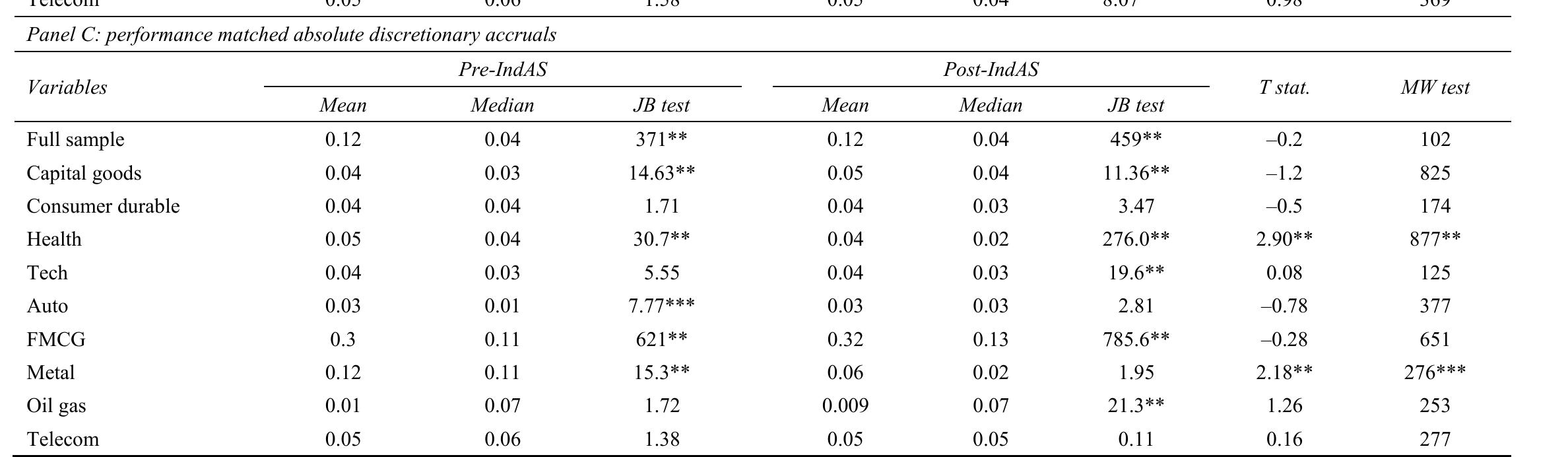

1. How do accounting measures such as earnings and book value influence stock market valuation over time?

This theme investigates the empirical relationship between fundamental accounting information—specifically earnings per share (EPS) and book value per share (BVPS)—and their value relevance to stock prices and market valuation. Understanding this connection sheds light on how financial statement components guide investor decisions and reflect firm performance in capital markets. This research area is crucial for assessing the effectiveness of accounting disclosures and for informing accounting standards regarding financial reporting and measurement.

2. What frameworks and methodologies enhance value assessment in managerial and organizational decision-making?

This research theme focuses on conceptual and methodological advancements in value management and value assessment processes that inform organizational decision-making. It includes practical frameworks for articulating and structuring values, benchmarking value management practices, and the use of value engineering or analysis methods to optimize cost-effectiveness without sacrificing functionality. Understanding how organizations identify, create, and measure value holistically is crucial for improving strategic planning, operational efficiency, and sustaining competitive advantage.

3. How can data value be systematically characterized, assessed, and integrated into organizational decision-making?

This theme explores the conceptualization, modeling, and measurement of data value as a critical asset influencing organizational outcomes. It addresses the challenges of defining data value due to its multidimensionality, subjectivity, and context-dependence, and investigates assessment methods and metrics that enable organizations to evaluate and utilize data more effectively. Advances in this area support improved data governance, investment prioritization, and realization of business benefits through data-driven strategies.