Key research themes

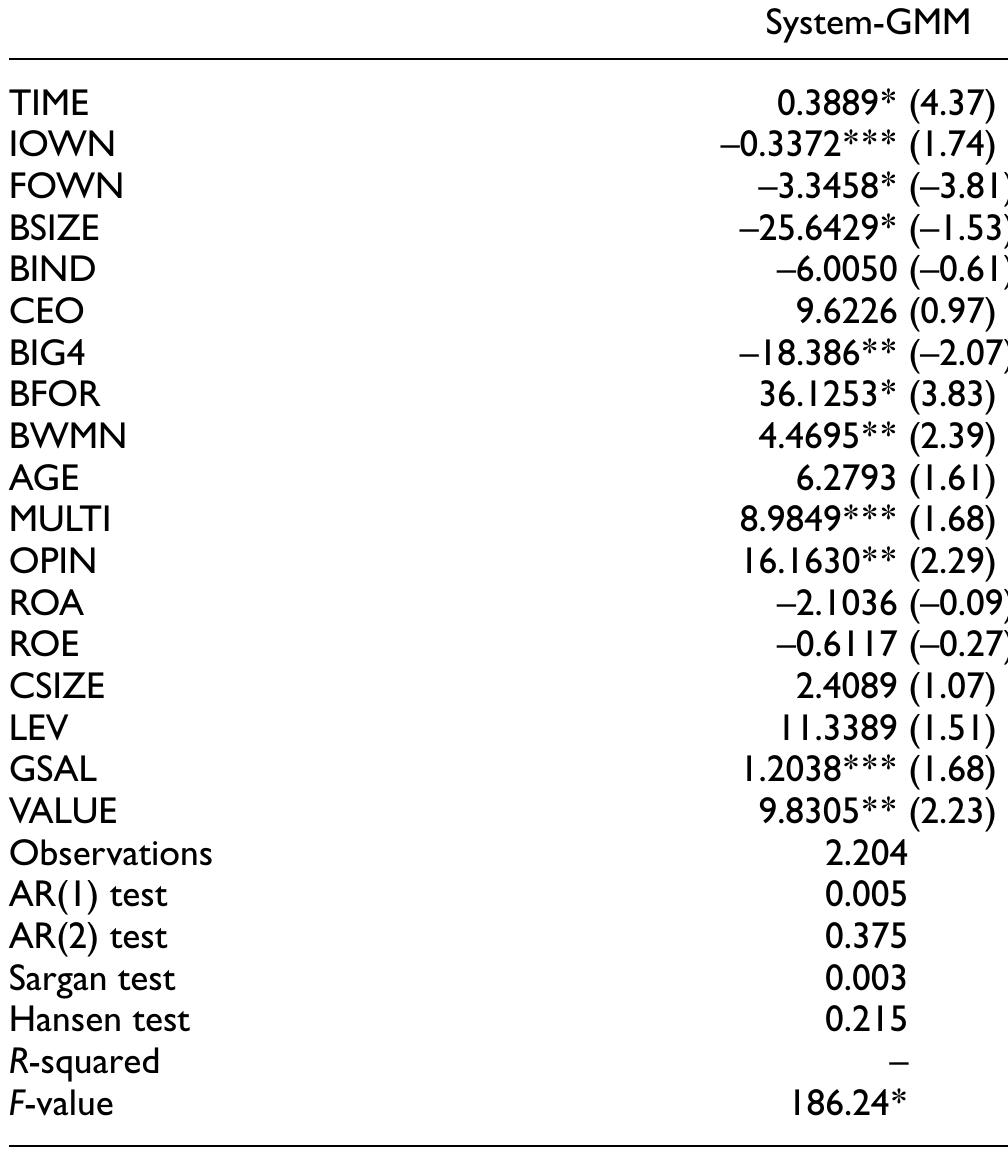

1. What corporate governance mechanisms influence financial reporting timeliness and how?

This research theme explores how aspects of corporate governance, particularly audit committee characteristics and broader governance quality, affect the promptness of financial reporting. Understanding these relationships matters because effective governance can facilitate quicker, more reliable financial disclosures that enhance transparency and aid investor decision-making. It also informs regulatory improvements in governance structures to promote timely reporting.

2. Which firm-specific and audit-related factors determine the timeliness of financial reporting in emerging markets?

This theme focuses on identifying characteristics intrinsic to firms and attributes of the audit process that affect how quickly financial reports are published. The importance lies in recognizing operational, size, and sectoral factors as well as audit complexity that either facilitate or delay timely disclosure, enabling stakeholders to understand and potentially mitigate lag risks prevalent in developing economies.

3. How does market capitalization affect audit report lag and financial reporting timeliness in emerging capital markets?

This theme investigates the relationship between firms' market capitalization levels and the duration between the end of financial periods and audit report publication dates (audit report lag, ARL). Understanding this relationship is vital because it captures how firm size and associated complexity influence audit timelines, investor risk assessment, and market information efficiency in emerging economies.